Ditch the chaos—automate expense tracking, invoicing, and profit insights. SparkReceipt gives freelancers and small businesses full financial control, saves 10+ hours monthly, and feels as intuitive as posting on social media.

Snap a photo, forward an email, or upload a file. SparkReceipt captures every detail from your receipts and invoices with unmatched accuracy.

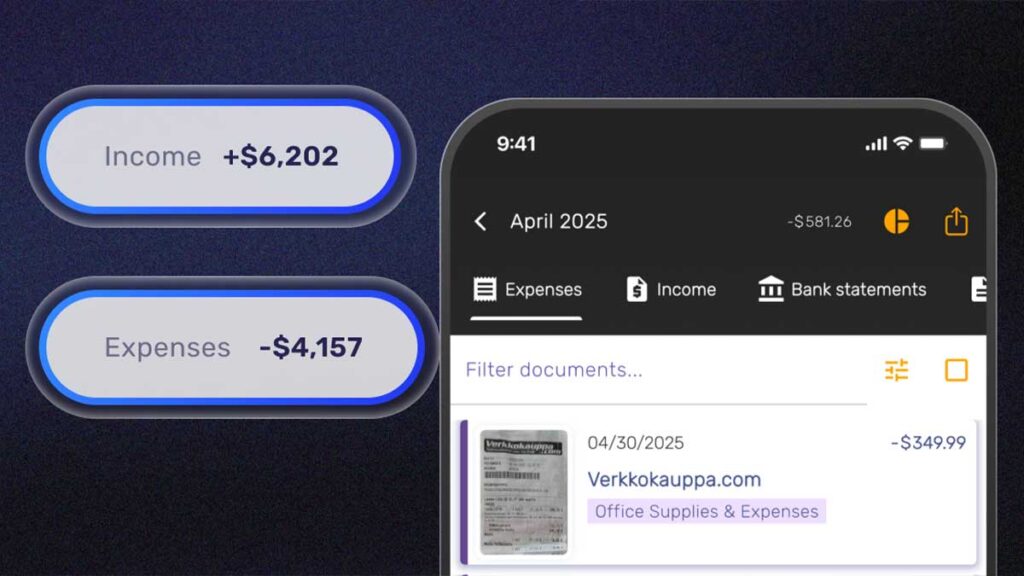

Each expense is sorted and categorized instantly, giving you an up-to-date view of your spending—ready for budgets, reports, or your accountant. It’s fast, accurate, and effortless.

Export clean, organized reports in PDF or Excel—complete with totals, categories, taxes, and links to original receipts. Perfect for accountants or tax authorities.

Filter by date, category, tag, or user, and include every important detail—vendor, tax breakdown, document type, and currency conversions. One click, and your expense tracker delivers everything you need for reporting, audits, or tax filing.

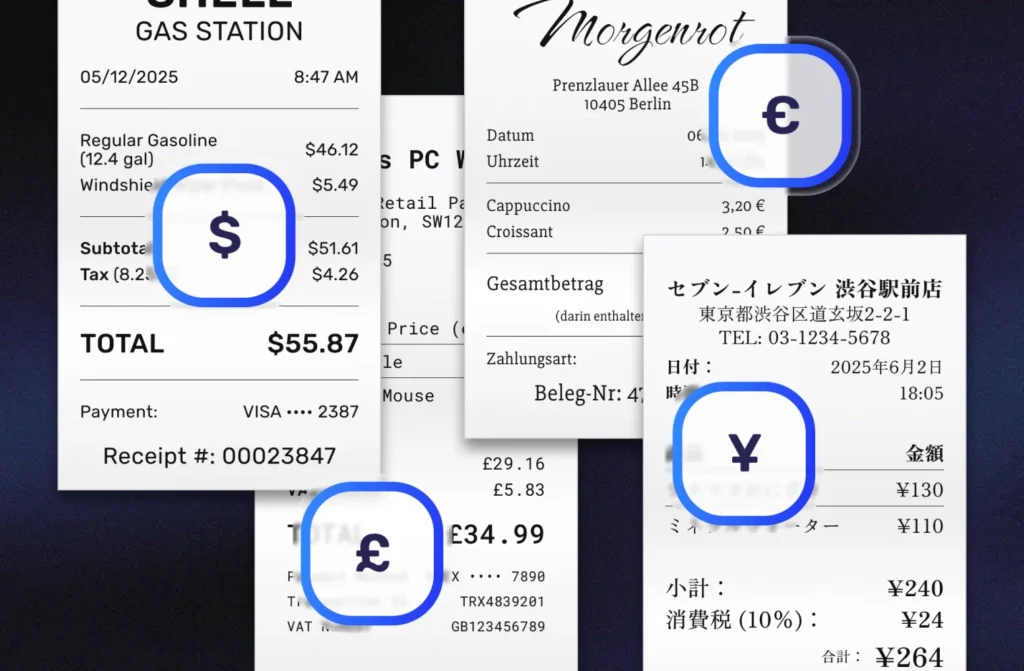

Log expenses in any language—our AI understands and categorizes documents from across the globe. OCR supports Latin-based scripts, and the app is available in English, French, German, Spanish, Japanese, and Finnish.

Manage spending in 150+ currencies with automatic daily exchange rates, and apply local tax rules—including multi-rate systems like GST and PST—for accurate, compliant expense tracking.

Upload bank or credit card statements in PDF, Excel, or CSV. SparkReceipt extracts every transaction and links it to the right expense entry using smart AI matching.

See instantly which transactions are missing receipts, so you can close gaps before tax time. No more manual reconciliation—just one clean, centralized, and fully traceable view of your expenses.

Every expense you track in SparkReceipt is instantly organized, categorized, and linked to transactions. Invite your accountant for free, and they’ll have full access to all your expense records—without using up a seat.

Because everything is already matched and ready, your accountant spends less time chasing receipts and more time keeping your finances in perfect order.

Not yet—but it’s coming soon! We’re actively developing a feature that will recognize and categorize individual line items from your receipts, making expense tracking even more detailed and effortless. Want to be among the first to try it? Sign up here to stay updated and get early access when it launches!

Yes, absolutely. You can create unlimited sub-accounts to keep your personal and business finances separate. Whether you’re managing a side hustle, multiple businesses, or household expenses, everything stays neatly organized and easy to track.

Nope. SparkReceipt’s AI automatically reads your receipts and assigns the correct category based on the contents. You can also customize your categories or apply your own rules if you prefer more control.

Yes. SparkReceipt supports both income and expense tracking. Whether you’re logging sales, client payments, or other income sources, the AI will detect and organize everything for you—making profit/loss overviews easy.

Yes. You can generate export-ready financial reports in PDF, Excel, or CSV format with just a few clicks. These reports include expense and income breakdowns, categories, and even links to the original receipts or invoices.

Definitely. You can invite your accountant or team members directly to your account for real-time collaboration. Alternatively, generate live links or export reports to share documents securely—no endless email threads required.

SparkReceipt’s AI uses advanced OCR and machine learning to extract data like vendor, date, total, and tax with high precision. In most cases, receipts are scanned and categorized in under 10 seconds, with minimal need for manual edits.

Over 150! SparkReceipt automatically detects the currency in your receipt and converts it using real-time or historical exchange rates. It’s perfect for freelancers and businesses operating internationally.