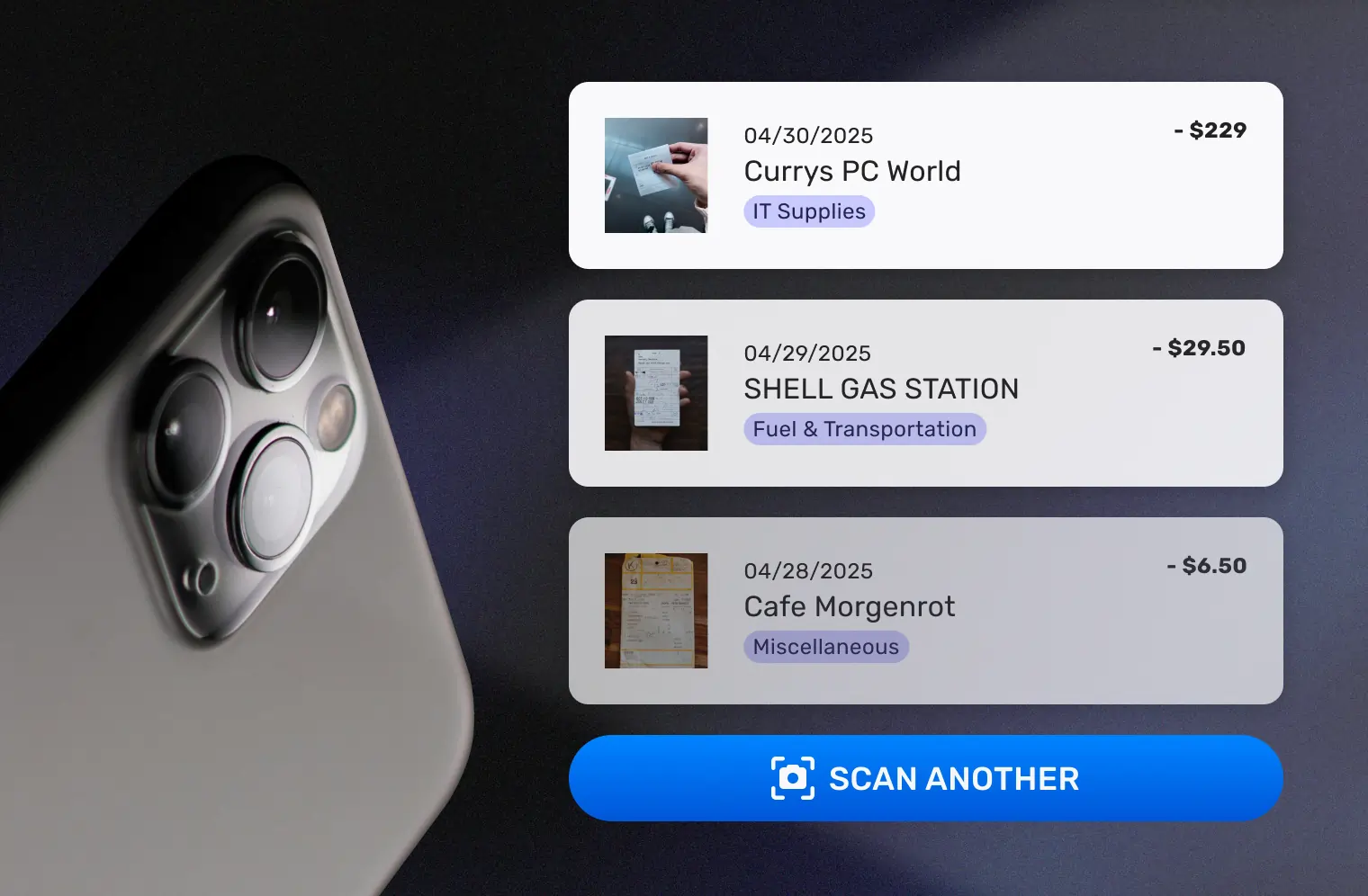

Snap, upload, or forward invoices—and SparkReceipt’s AI instantly extracts every detail, categorizes expenses, and keeps your books clean. Spend less time on paperwork and more time running your business.

Upload a PDF, forward an email, or snap a photo—SparkReceipt’s AI scans every invoice with pinpoint accuracy. Amounts, vendors, dates, taxes, and currencies are extracted instantly, no typing required.

Your invoices are neatly categorized and ready for expense tracking, reports, or your accountant—so you never waste time digging through files again.

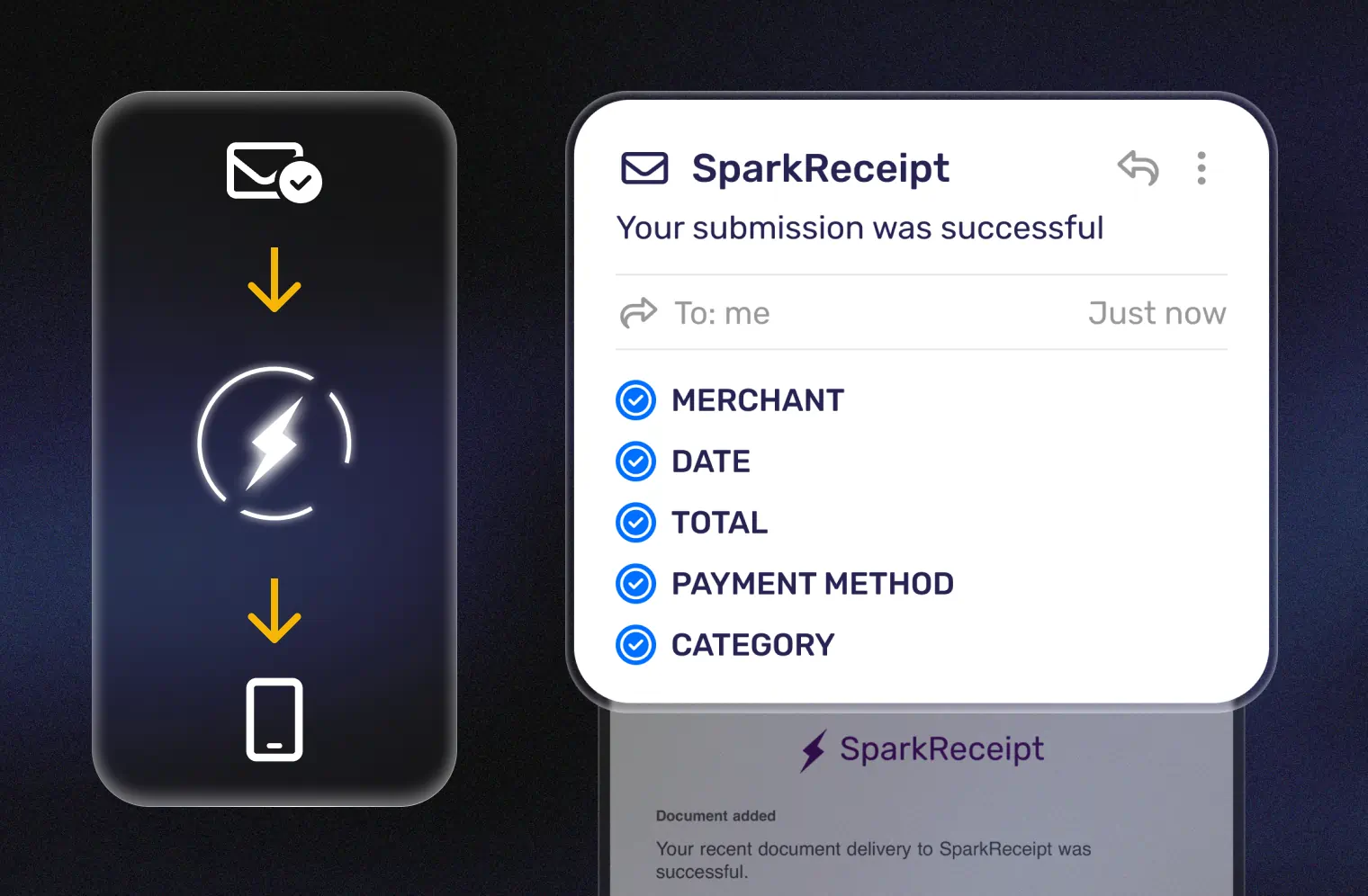

Forward any email invoice to SparkReceipt and it’s scanned, organized, and categorized automatically—just like paper invoices.

Want total automation? Set up email auto-forwarding once, and every incoming invoice is processed instantly, with zero effort on your part.

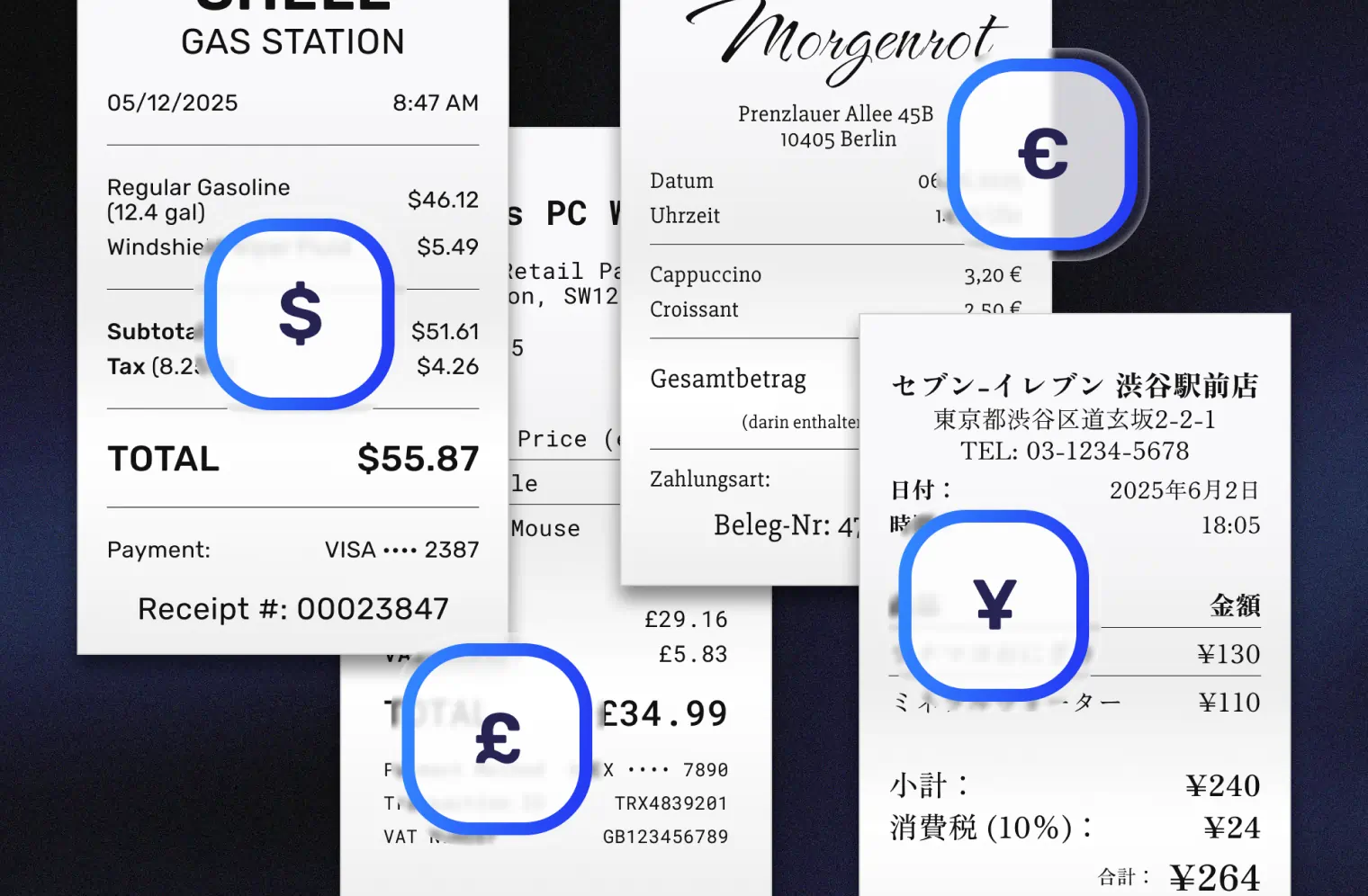

Scan invoices in any language—our AI understands and categorizes documents from across the globe. OCR supports Latin-based scripts, and the app is available in English, French, German, Spanish, Japanese, and Finnish.

Track expenses in 150+ currencies with automatic exchange rates, and apply local tax rules—including multi-rate systems like GST and PST—for accurate, compliant invoice records.

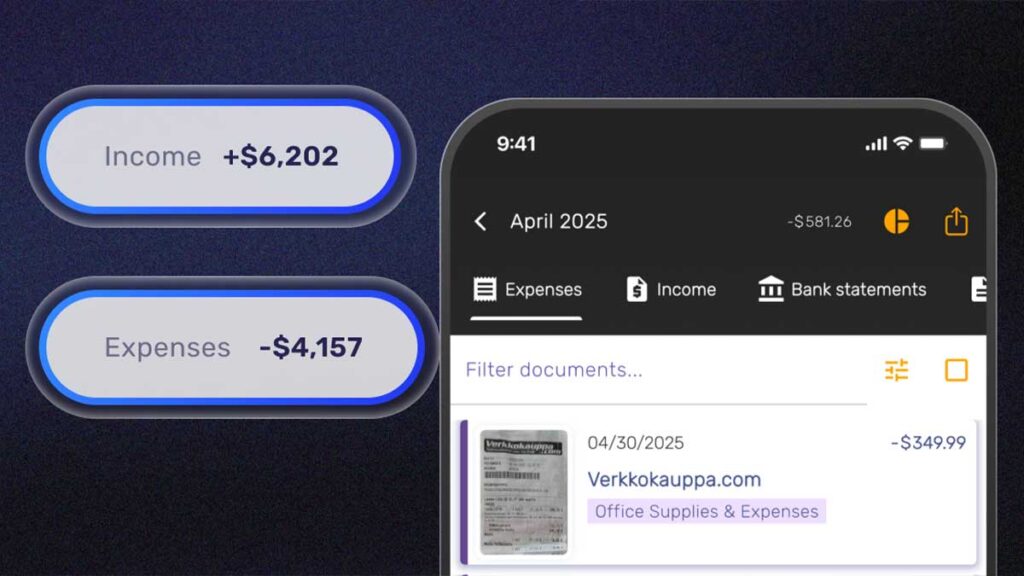

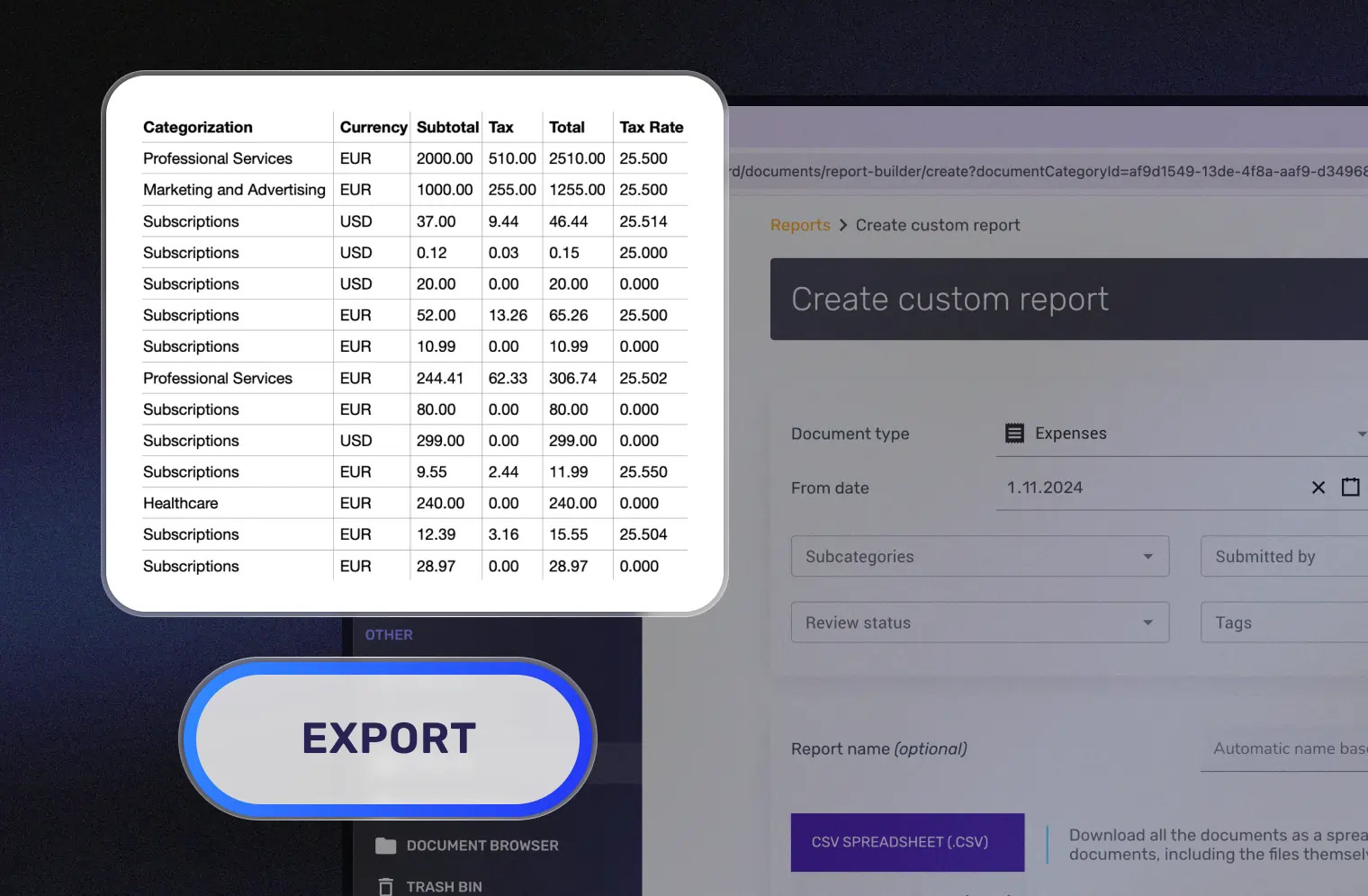

Export clean, organized reports in PDF or Excel—complete with totals, categories, taxes, and links to original invoices. Perfect for accountants, clients, or tax authorities.

Filter by date, category, tag, or user, and include every key detail—vendor, tax breakdown, document type, and currency conversions. One click, and your invoices are transformed into professional reports, ready for audits or tax filing.

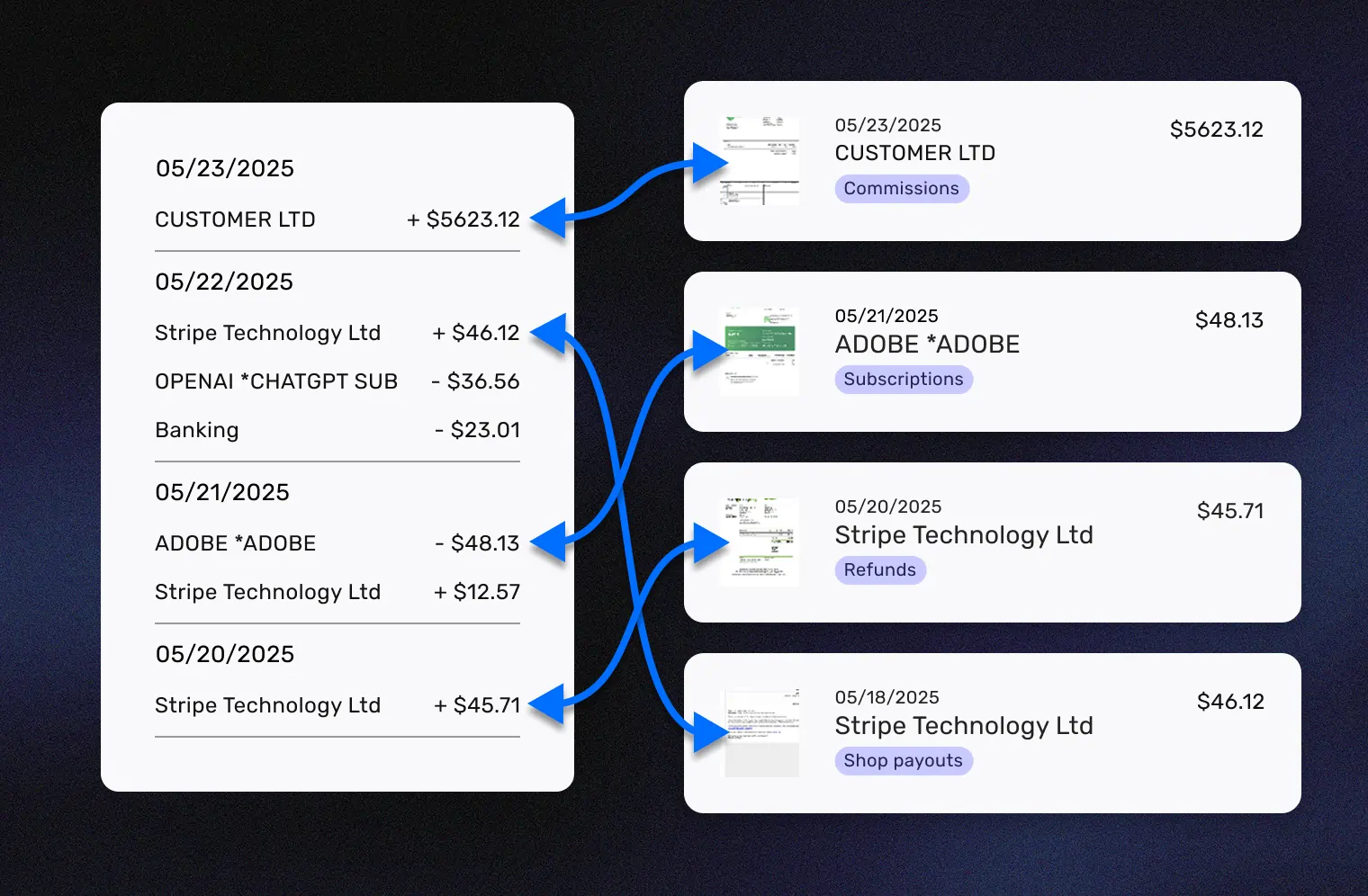

Upload bank or credit card statements in PDF, Excel, or CSV. SparkReceipt extracts every transaction and links it to the correct invoice with smart AI matching.

Instantly see which payments are missing invoices, so you can fix gaps before tax time. No more manual reconciliation—just one clean, centralized, and fully traceable view of your finances.

Every invoice you scan in SparkReceipt is instantly organized, categorized, and linked to transactions. Invite your accountant for free, and they’ll have full access to all your documents—without using up a seat.

Because everything is already matched and ready, your accountant spends less time chasing receipts and more time getting your books done right.

Yes. You can scan paper invoices with your phone camera, upload PDFs, or even forward invoices received via email. SparkReceipt’s AI extracts all key details—amounts, dates, vendors, taxes, and currencies.

Absolutely. Our AI supports invoices in any language, tracks expenses in 150+ currencies, and applies local tax rules (like VAT, GST, or PST) automatically for accurate reporting.

Yes. All scanned invoices are categorized and ready for export in PDF, Excel, or CSV. Reports include totals, taxes, and direct links to original invoices—perfect for accountants, audits, or tax filing.

It will. Simply upload your bank or credit card statement, and SparkReceipt automatically matches each transaction to the right invoice. You’ll also see instantly if a payment is missing documentation.

It will. Simply upload your bank or credit card statement, and SparkReceipt automatically matches each transaction to the right invoice. You’ll also see instantly if a payment is missing documentation.

No. SparkReceipt’s AI does the heavy lifting for you. It extracts vendors, amounts, dates, taxes, and categories automatically—saving you hours of manual data entry.

Yes. You can invite your accountant for free without using up a seat. They’ll have secure access to all scanned invoices and reports—no more email attachments or messy folders.