Capture every deductible mile automatically, keep business and personal driving separate, and stay tax-ready without spreadsheets or manual logs.

SparkReceipt is designed to capture your trips automatically as you go about your day, so mileage tracking does not depend on memory or manual effort. Every drive is recorded for review, helping ensure no business miles slip through the cracks.

Instead of trying to reconstruct trips weeks later, you can rely on a complete trip history that is always there when you need it. This means more accurate records, less stress, and more deductible mileage captured over time.

Not every trip counts as a business expense. SparkReceipt makes it easy to separate business and personal driving, so your records stay accurate and compliant.

With simple trip classification, only legitimate business mileage is included in your totals. This keeps your deductions clean, reduces the risk of errors, and makes it easier to explain your records if questions ever come up at tax time.

SparkReceipt stores your mileage with key details such as dates, distances, and trip history, helping you maintain proper documentation throughout the year.

Instead of scrambling during tax season, your mileage records are already organized and easy to access. Whether you file on your own or work with an accountant, having clear and complete mileage data helps simplify the entire process.

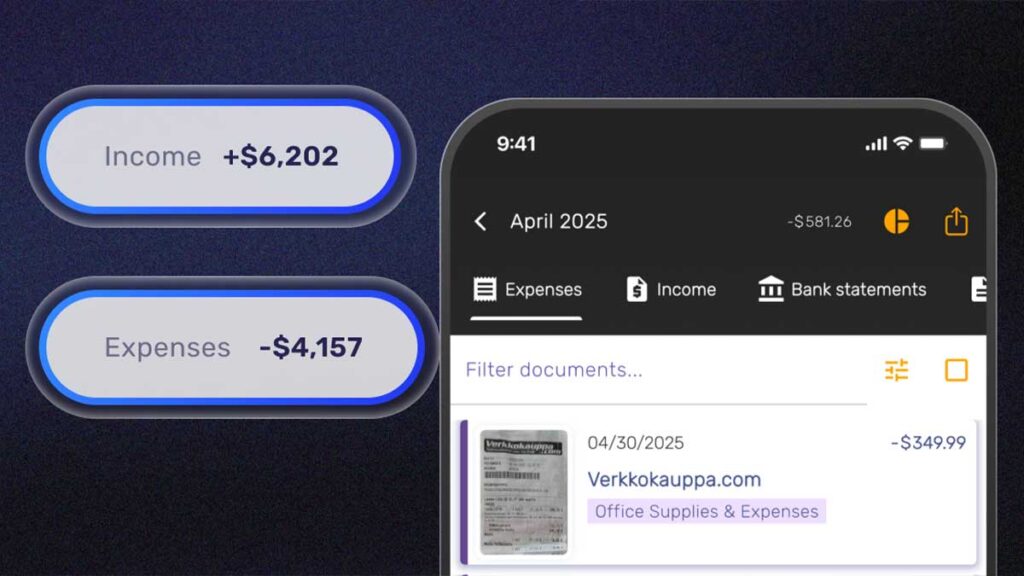

SparkReceipt turns raw trip data into clear mileage totals, so you can quickly see how much you have driven for business over time.

By understanding your mileage patterns and totals, you gain better visibility into potential deductions and business costs. No spreadsheets or manual calculations required. Just straightforward numbers that help you make better financial decisions.

Mileage does not exist in isolation. SparkReceipt keeps your mileage alongside receipts, expenses, and financial documents in one secure place.

This creates a more complete view of your business activity and reduces the need to jump between multiple tools. When it is time to share information with your accountant or prepare reports, everything is already organized and easy to find.

Yes. SparkReceipt is being built to capture trips automatically, so you do not have to manually log mileage. You will be able to review and classify trips before they count as business mileage.

No. The goal is to eliminate manual mileage logs and spreadsheets. SparkReceipt is designed to reduce effort while keeping records accurate and organized.

Yes. You will be able to mark trips as business or personal easily, helping you keep clean and deductible records.

SparkReceipt helps you maintain detailed mileage records with dates and distances, which are commonly required for tax reporting. Always check local tax rules, as requirements vary by country.

Plan availability will be shared closer to launch. Waitlist members will be the first to receive updates and access details.

The mileage tracker is currently in development. Join the waitlist to be notified as soon as early access becomes available.

Yes. SparkReceipt is built for international use and will work in countries worldwide. Mileage records are supported across 150+ currencies, and the interface is designed to work in all languages, so you can track trips wherever you do business.