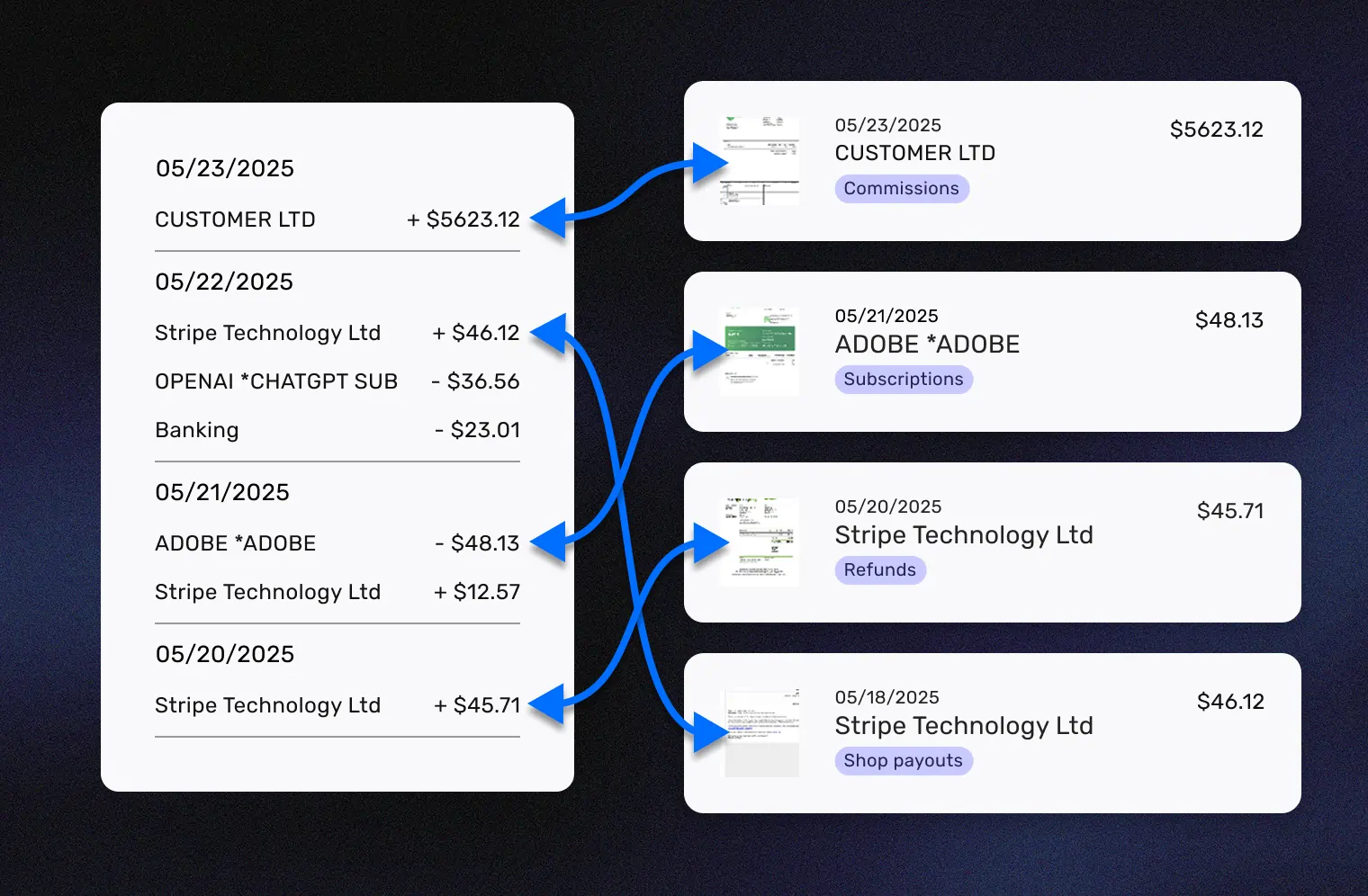

Upload your bank or credit card statements, and SparkReceipt transforms them into organized, searchable transactions in seconds. Our AI then matches each one to the right receipt or invoice – so reconciliation is fast, accurate, and effortless.

Lock in our best deal ever – only $6.58 USD per month (*billed annually at $79 USD/year). Stay subscribed, and your price will never go up, even as SparkReceipt gets better. This lifetime pricing is limited to the first 15,000 users. With our 60-day money-back guarantee, there’s no risk in trying.

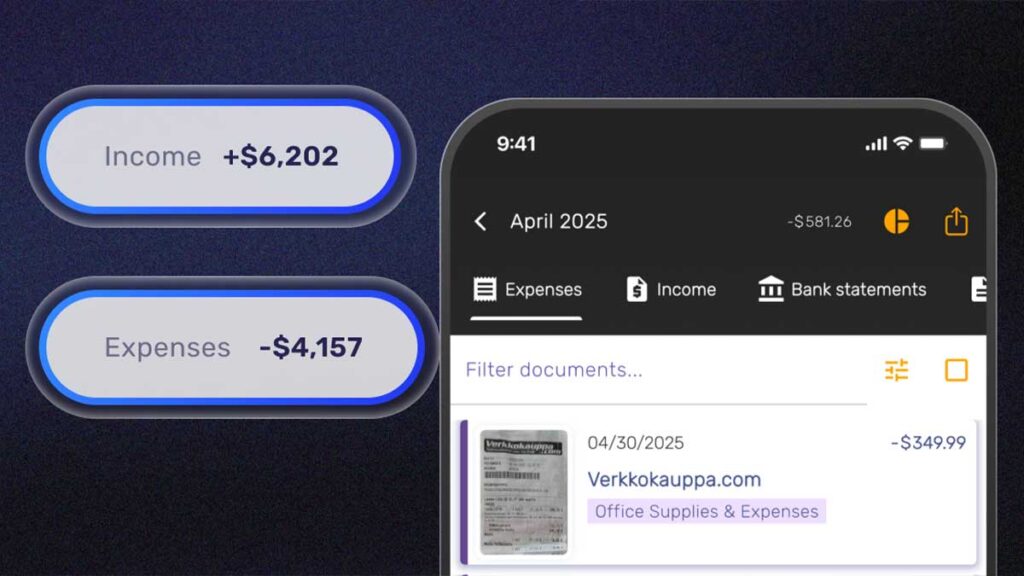

Stop wasting time chasing receipts or typing transactions into spreadsheets. Upload your receipts and bank or credit card statements, and SparkReceipt’s AI will match them automatically. Whether it’s tax prep, month-end close, or filling in missing receipts, reconciliation is done in minutes—not hours.

Every transaction is automatically linked to its matching receipt or invoice, giving you complete traceability. With all documents, dates, and amounts connected in one place, you can stop digging through folders and start making confident, data-driven decisions.

SparkReceipt’s AI-driven matching is as precise as it is fast. By automatically pairing receipts with transactions, it eliminates human error while giving you full control to review, adjust, or verify whenever you need.

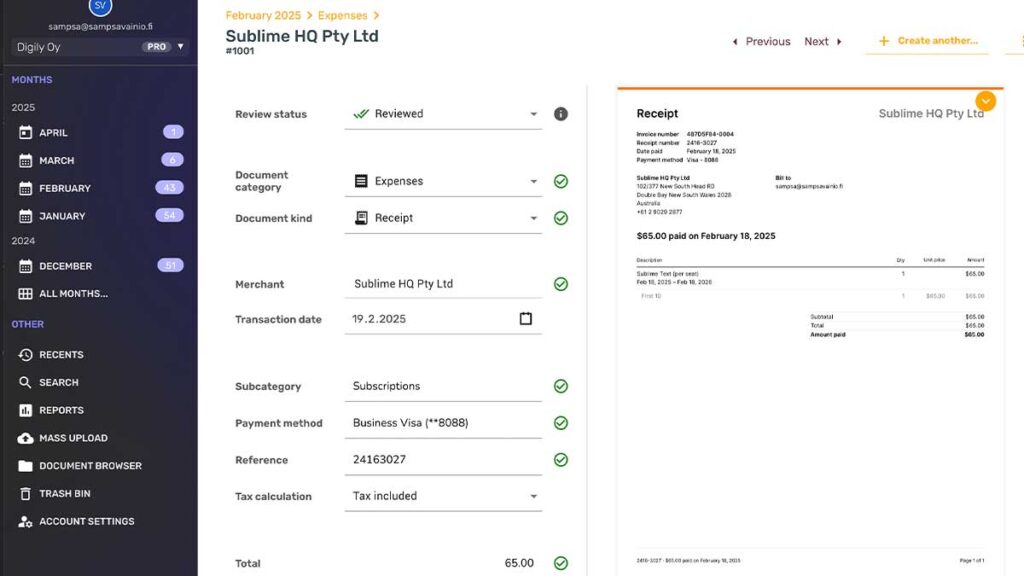

You can upload bank and credit card statements in PDF, Excel, or CSV formats. SparkReceipt supports files from most financial institutions worldwide.

Our AI automatically reads and extracts every transaction detail—dates, amounts, payees, and descriptions—with industry-leading accuracy. You can review, edit, or add notes anytime for 100% clarity and control.

Yes. SparkReceipt automatically matches transactions with your uploaded receipts and invoices based on date, amount, and merchant name. This saves hours of manual reconciliation and helps ensure you don’t miss anything.

No problem—you can manually review and match any remaining transactions. SparkReceipt gives you full visibility and control, so nothing slips through the cracks.

Absolutely. All uploaded statements and receipts are encrypted and processed securely. We never share your data with third parties.

You can use credits to extract transactions from uploaded bank statements. Extracting the transactions allows SparkReceipt to automatically match your receipts and invoices to the transactions found in your bank statement. By matching transactions with receipts, you will immediately see if you have any missing receipts.

Pro-users start with 300 credits, which let you extract roughly 300 transactions monthly. You can purchase extra credits from the web application by going to Account Settings > Subscription & Billing. The price is $12 USD for 1000 extra credits.