Stop typing data into QuickBooks. With SparkReceipt’s direct integration, every receipt, invoice, and expense flows into your books automatically and accurately. No more manual entry, no more missed transactions – just clean, up-to-date records ready for reporting.

Just choose the receipts and invoices you want to export. Already delivered documents are marked, so you’ll never lose track.

With the click of a button, your selected documents are exported directly to QuickBooks via API.

Your documents appear in QuickBooks, allowing you to view and edit them as needed without switching between platforms.

SparkReceipt automatically imports your QuickBooks expense categories, income categories, merchant list, and even tax codes, streamlining the entire process.

A few clicks, and your documents are where they need to be.

Save hours of manual data entry with our API-connection.

No more human errors when transferring data.

Sync categories and data effortlessly between platforms.

Snap a photo or upload a file. Our AI-powered receipt scanner processes your receipts and invoices in seconds—not minutes—delivering unmatched accuracy in every detail.

Your documents are sorted and categorized instantly, ready for reports, taxes, or your accountant. It’s fast, flawless, and effortless.

Forward any email receipt to SparkReceipt and it’s scanned, organized, and categorized automatically—just like paper receipts.

Want total automation? Set up email auto-forwarding once, and every incoming receipt is processed instantly, with zero effort on your part.

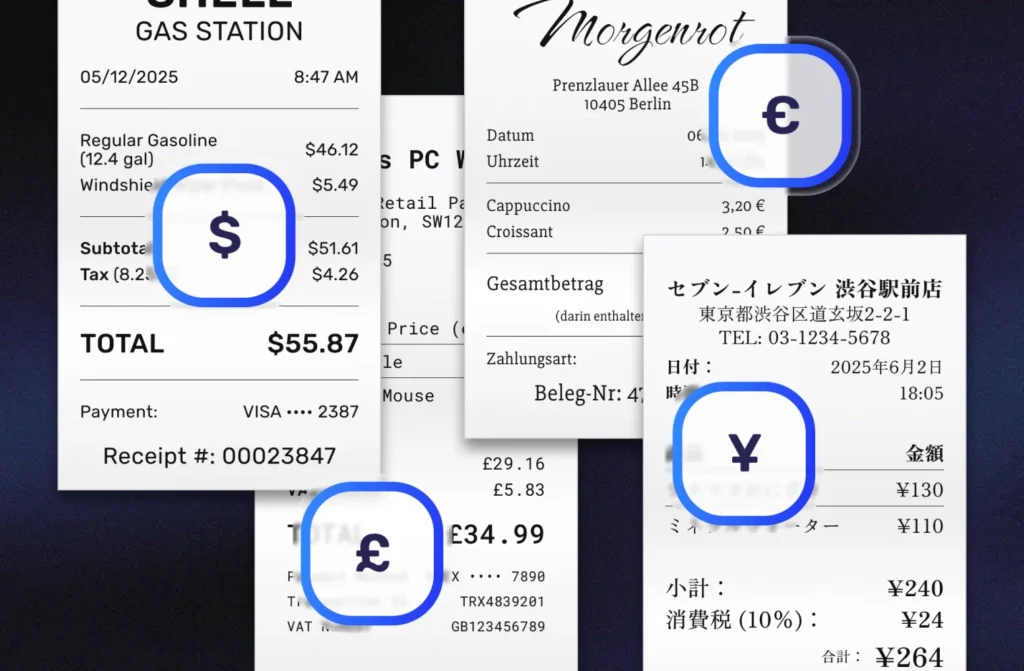

Log expenses in any language—our AI understands and categorizes documents from across the globe. OCR supports Latin-based scripts, and the app is available in English, French, German, Spanish, Japanese, and Finnish.

Manage spending in 150+ currencies with automatic daily exchange rates, and apply local tax rules—including multi-rate systems like GST and PST—for accurate, compliant expense tracking.

Export clean, organized reports in PDF or Excel—complete with totals, categories, taxes, and links to original receipts. Perfect for accountants or tax authorities.

Filter by date, category, tag, or user, and include every important detail—vendor, tax breakdown, document type, and currency conversions. One click, and your expense tracker delivers everything you need for reporting, audits, or tax filing.

Snap a photo of your receipt, forward an email, or upload a file—our AI extracts key details instantly. No manual entry, no hassle.

Not yet—but it’s coming soon! We’re actively developing a feature that will recognize and categorize individual line items from your receipts, making expense tracking even more detailed and effortless. Want to be among the first to try it? Sign up here to stay updated and get early access when it launches!

SparkReceipt handles physical receipts, PDFs, email receipts, invoices, and even CSV, Excel, and Word files. If it has numbers, our AI can read it.

Each plan comes with a monthly document limit—15 for Free, 100 for Pro, and 500 for Elite. If you ever need more, you can purchase extra credits at any time: 1,000 credits for $12 USD. One credit equals one document, so you’ll always have the flexibility to scan exactly what you need without upgrading your plan.

We store your receipts for a minimum of 10 years, ensuring you always have access to your financial records when you need them. Even if you cancel your subscription, your data remains available for viewing and export.

SparkReceipt is designed for global use and trusted by users in over 100 countries, including the UK, United States, Canada, Australia, and across Europe. The app interface is available in English, French, Finnish, German, and Japanese.

Our advanced AI, powered by large language models, can read receipts in nearly any language—including all Latin-variant languages (those using a–z with characters like ä, ö, å, ü, and ß), Japanese, and both simplified and traditional Chinese.

Yes! Whether it’s USD, EUR, JPY, or any other currency, SparkReceipt automatically detects amounts and converts them using real-time exchange rates. It also reads receipts in most languages.

SparkReceipt’s AI doesn’t just scan—it understands. Unlike basic OCR, it identifies merchants, dates, amounts, and taxes with high precision, reducing errors and manual corrections.

No! SparkReceipt’s AI suggests categories based on the contents of your receipts. You can also create custom rules to automate categorization, saving even more time.

Yes. SparkReceipt supports both income and expense tracking. Whether you’re logging sales, client payments, or other income sources, the AI will detect and organize everything for you—making profit/loss overviews easy.

You can use credits to extract transactions from uploaded bank statements. Extracting the transactions allows SparkReceipt to automatically match your receipts and invoices to the transactions found in your bank statement. By matching transactions with receipts, you will immediately see if you have any missing receipts.

Pro-users start with 300 credits, which let you extract roughly 300 transactions monthly. You can purchase extra credits from the web application by going to Account Settings > Subscription & Billing. The price is $12 USD for 1000 extra credits.

Yes! You can:

Share a live access link so accountants or colleagues can instantly view all receipts, invoices, and expenses—neatly sorted and categorized.

Invite team members or an accountant to collaborate inside your account, so there’s no need for messy email attachments.

Absolutely! You can create unlimited sub-accounts (workspaces) to keep different businesses or projects separate. Adding users to each workspace is easy, making collaboration effortless.

SparkReceipt is built for freelancers, small business owners, independent contractors, and entrepreneurs who need an easy way to track expenses, income and taxes without manual data entry. Whether you’re a solo entrepreneur or running a growing team, SparkReceipt keeps your finances organized.

Yes, you can export all your receipts in PDF, CSV, or Excel anytime—perfect for accounting and tax reporting.